2021-12-14

产品展示

Product display

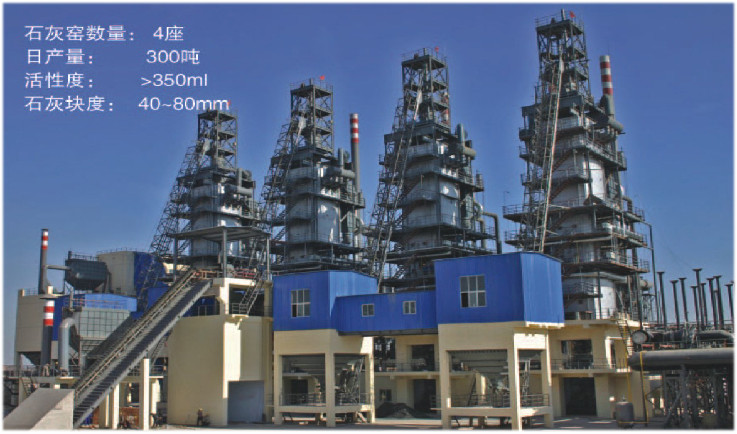

太阳成集团

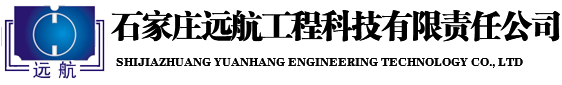

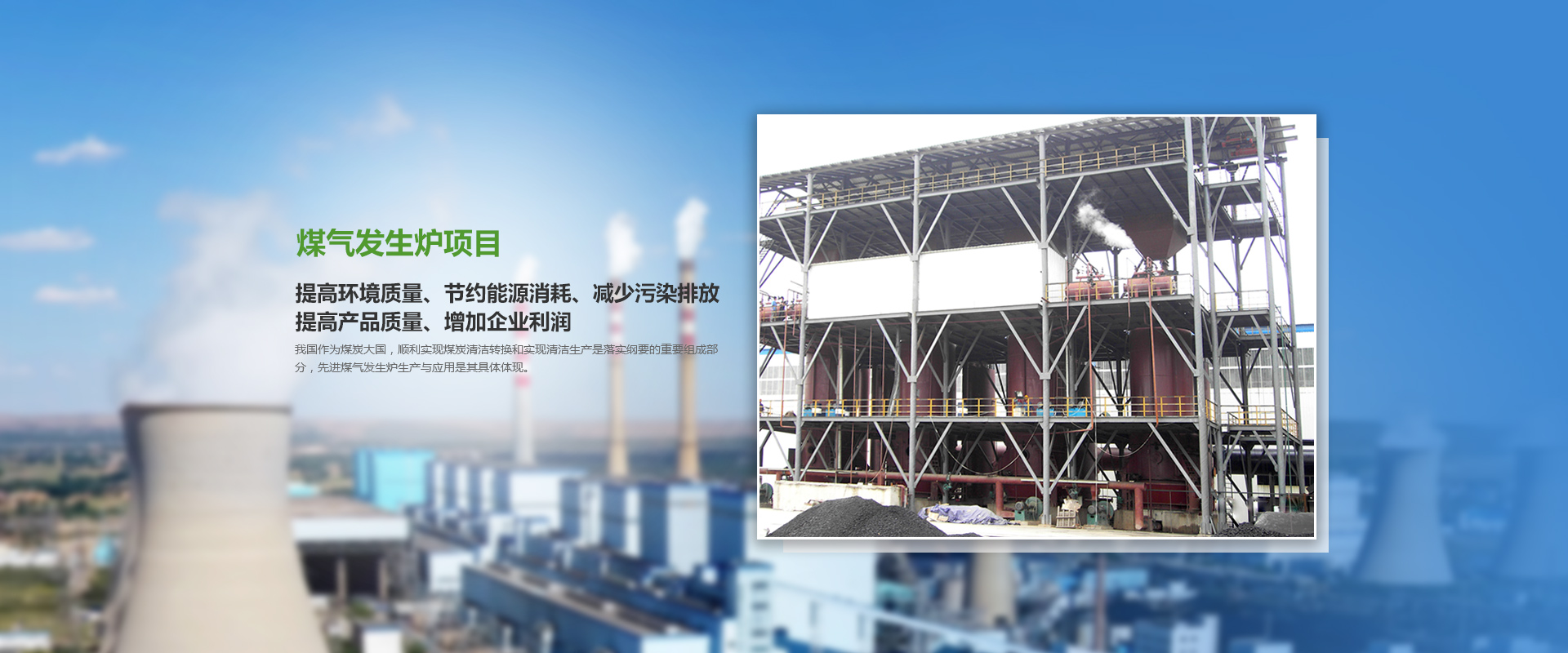

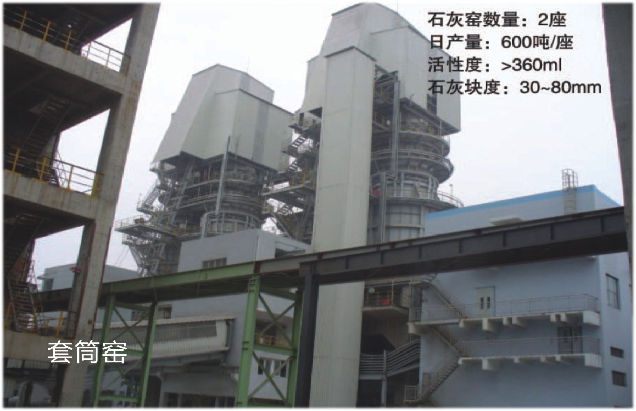

suncitygroup太阳新城客户端专业生产双段式煤气发生炉,环保石灰窑,余热换热器等设备,是以科技知识,人才为先导,集科研开发,工程设计,设备制造,安装调试,销售服务为一体的综合性企业。 suncitygroup太阳新城客户端是经中华人民共和国质检总局批准验收的D级压力容器(一,二类压力容器)制造企业,压力容器证编号:TS2213260-2025。主要生产的煤气发生炉设备、双段式煤气...

suncitygroup太阳新城客户端专业生产双段式煤气发生炉,环保石灰窑,余热换热器等设备,是以科技知识,人才为先导,集科研开发,工程设计,设备制造,安装调试,销售服务为一体的综合性企业。 ...

Copyright © suncitygroup太阳新城(中国)集团官方网站 版权所有 Powered by EyouCms备案号:冀ICP备2021023697号-1